Hunting for the best payment tracking software? Well, in this article you will finally trap the beast.

Every company once in their lifecycle goes into a brief hiatus for auditing and determining the reason for declining revenues. But here comes the problem, without proper money trails even the best auditors can’t figure out the source of revenue leakage. At this point, they just wish for a good payment tracking software to track and plug the leak.

![]()

Well, don’t worry this is 2022 and the digital market is swamped with many free and cheap payment tracking applications. But before you jump into any, you must know that every good tracking software must have these mandatory features.

- Tracking/Filtering Indicators

- Dunning Management

- Segmentation Tools

- Interactive Dashboard

Keeping these features in mind and including reasonable pricing, I have jotted down the 5 best payment tracking software. Come have a look.

| Quick Comparison Between The Best Payment Tracking Software | |||||

| Service | Basic Plan | Affiliate Modules | Dunning Management | Revenue Limit | |

| Pabbly Subscription Billing | $19/m | ✔ | ✔ | Unlimited | |

| Putler | $29/m | ✖ | NA | 300 | |

| Baremetrics | Get Quote | ✖ | ✖ | NA | |

| Fisglobal | $49/m | ✖ | ✖ | Unlimited | |

| Apptivo | $8/m | ✔ | NA | 2000 | |

1. Pabbly Subscription Billing – Best Payment Tracking Software

“The only software available in the market that doesn’t restrict users on any features by offering unlimited revenues, integrations, payment tracking and much more even in a basic plan.”

Pabbly Subscription Billing has an awesome inbuilt payment tracker which filters a maze of complex data, then segments into different buckets and presents in a fun and simple way. Also, your customers can track their account details, upgrade/downgrade subscriptions and manage credits & invoices in their own dedicated customer portal.

The best part is you can bill unlimited revenue at zero transaction costs in very nominal pricing. Also, it offers many multiple billing models like recurring, one time, and based on periods.

Features

- Dashboard – Its interactive dashboard gives a fair idea about the total sales, the addition of new subscribers and refunds & cancellation in a single panel per customer. Furthermore, in the bottom section, the customer’s data like name, email, live status, and product type is shown for you to analyze.

- Dunning Management – Send automatic email messages as reminders to your clients upon the impending closure of their subscription accounts as for the lack of payment provision. This keeps you in a loop with the customers and plug in revenue deficits.

- Reports – This application can segment data like net revenue, MRR, active customers, subscriptions, and many more. Furthermore, all these data will be available in the form of graphs, pie charts, and more.

- Email Notification – Both merchants and customers receive instant email notifications on events like successful completion of payment. Also on the expiration of the subscription, failure of payments, and other transactional glitches. As a merchant, this can be immensely helpful in tracking revenue flows and removing bad subscribers.

- Client Portal – Your customers can also track their payments in their dedicated client portals. Furthermore here they can cancel or edit their subscriptions, change their card details, and download invoices.

- Tax Management – All the invoices generated are compatible with the tax laws of the customers’ country of origin.

- Affiliate Modules – With these integrated affiliate modules you can start your own referral program by offering some commissions your friends can log in to become your affiliates and promote your products.

- Integration – For third-party integrations the Webhook & API allows you to integrate with Xero, Netsuite, Quickbooks, and many more platforms.

- Custom Branding – Built your custom domain, insert the logo, and even change the background image of the client interface with Pabbly Subscription Billing.

Pricing

There are five pricing plans based on the number of customers

- Starter – In $19 per month it services 50 customers and can do unlimited revenue billing. All the above-mentioned features are found in this plan.

- Rookie – Priced at just $37/month and you can do unlimited billing for 100 customers.

- Pro – Bills 150 customers at $57 per month.

- Advanced – Caters to 250 customers for just $79/month and to scale up the number of customers so that pricing will rise automatically.

- Enterprise – Known as the super account, this for customers beyond 50k, you need to get in touch with their sales team to fully explore this functionality.

2. Putler – A Versatile Payment Tracker

Putler has a track record of more than 7 years for providing meaningful e-commerce solutions. They promise a solid conversion of all types of currencies automatically. Also, the best part is Putler works as an autonomous self-functioning employee so that you can make confident data-driven decisions. Furthermore to segment and track payment data they offer 150+ key indicators.

Features

- Dashboard – Here you track payments, the daily average of sales, and build profiles. Also can manage subscriptions and issue refunds 10x faster than its peers.

- Analytics – They provide analytic tools for both Saas and Non-Saas applications.

- Payment Integrations – Integrations between multiple businesses, eCommerce, payment gateways, and currencies are easy. Furthermore, consolidate multiple payment gateways, stores and even do automatic de-duplication.

- Subscription Management – All types of subscription models can be managed with ease. Also, you can easily export data to CSV, engage in timezone conversion, and currency enrichment.

- Marketing – In Putler’s own domain you can view stats from Google Analytics. Then export mailing lists from Putler to Mail Chimp, and run target campaigns on Facebook.

Pricing

Comes in three pricing plans based on orders

- Scale – At $29/month get an analysis of 300 orders.

- Growth – Work on 3,000 orders with 5 years of historical data at just $70/month. Once can issue refunds and can perform RFM segmentation.

- Scale – Do analytics on 7 years of historical data at $249/month. Plus you will be provided with a dedicated accounts manager.

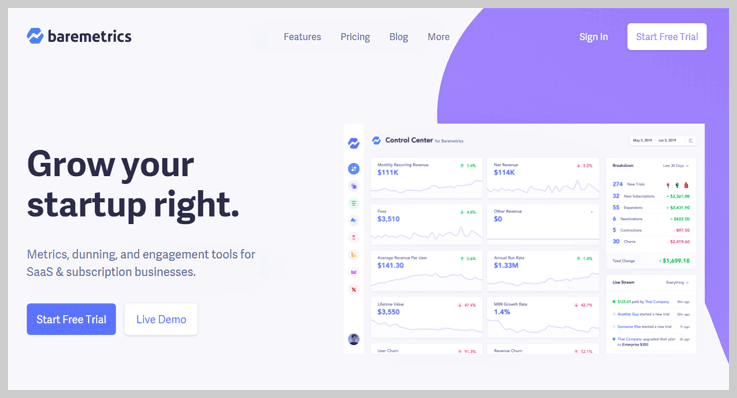

3. Baremetrics – Payment Tracking Laid Bare

Baremetrics specializes in reducing unnecessary data noises and offers a rich perspective for you to make remarkable decisions. Integrations with multiple applications like Stripe Braintree, Recurly, Google Pay, and App Store Connect are easy. They have updated their networks for the third time.

Features

- Forecasting – Based on tracking various data and past historical clients’ behavior you can predict future events related to the payment transactions.

- Control Hub – Several key attributes like consumer churn and revenue leakage can be easily sorted in this control hub.

- People Insight – Consumer feedbacks can be segmented with the help of various filters. And this, in turn, will help you to understand the grievances and glitches.

- Slack Tools – Integrate your statistics & tracking metrics with your data slack channels and even share it with your team members.

- Embedding – Adding Baremetrics to all the applications with just a couple of APIs.

Pricing

A slider moves with prices accordingly in proportion with the monthly revenue rate. Also, you should take their 14 days free trial period to explore their applications.

4. Fisglobal – Integrated Global Processor

Fisglobal is a highly diversified, NYSE listed finance company. They provide payment tracking and processing services in merchant transactions, banking, and capital markets. The reason they have an advantage over other competitors is that they keep evolving according to the global trends. They also have significant expertise in B2B eCommerce cloud solutions as this is their primary domain.

Features

- Risk Reporting – As an asset management company they have highly refined data processing and tracking to reduce collateral damage in securities, blue-chip trading, and even in core administration. Once accepted using cookies your client’s data based on his browsing history will be available within the limits of GDPR.

- Monitoring – Get real-time payment monitoring to reduce blind spots in payment rails, front end payment devices, and even switches. As a merchant, you can track cross border payments with SWIFT global payment innovations.

- Worldpay ONE – This comes with a platform for developers to build, test, and then even authenticate solutions in payment technologies, security threats, and other industry standards.

- Omni Channel – It doesn’t matter what device or what channel you are using, you can improve your bottom line with high-quality payment processing.

- Support – A very responsive support to ensure your interaction during the set remains smooth. Integration is easy with a couple of APIs and docs are provided to ace the system.

Pricing

Their pricing is tailor-made according to the needs and specifications. Hence contact their sales representatives.

5. Apptivo – Software With An Edge

Payment processing and tracking in industries like travel, real estate, utilities, and NGOs. It creates an environment where both customer payment and maintenance of payments can be done with ease and tranquility. Besides their apps work seamlessly in all the three mobile operating systems like macOS, Andriod, and Windows.

Features

- Dashboard – A very interactive dashboard that displays lists like performance, win and lead analysis, pipeline by stage, kanban, intelligent charts, and more.

- Security – A massive security complex based on field-based, role-based and territory management

- Integrations – Offcourse standard integrations like PayPal, Stripe, Authorize.Net, and also newly introduced ones like RingCentral, Nexmo, Google Pay, and more.

- Easy Data – Structure your payment data in one centralized hub and then manage it from different branches as in-depth analysis may help you to increase customer loyalty. Also the migration from other CRMs is quite easy.

- Reports – Reports like standard, scheduled, and custom is issued in the form of various bar graphs, pie charts, and more for easy understanding.

Pricing

- Starter – At $0/month access standard reports for 3 users with 500MB storage. Though filters are not available with this plan.

- Premium – Their featured plan is positioned at $8/month with 2000 API calls and multiple 3rd party integration.

- Ultimate – All the benefits of the Premium plan are included in this package with additional benefits like 3000 emails/users and massive 20,000 API calls.

- Enterprise – A custom made plan with white labeling, payment reports in multi formats, and one dedicated account manager.

Conclusion –

Viola, these are the 5 best payment tracking software available in digital financial markets. The rationale behind listing the software was its incredible features and affordable pricing. Furthermore, I should remind you that there is a demo account or free trial available with all this service. Do try them out individually before searching for your credit card.

Also, if you have any queries regarding any of these software do ping me in the comment section below.